- The joint venture known between Ford and SK On Co. had already been awarded subsidies by the Kentucky and Tennessee state governments.

- BlueOval SK has planned capacity of 120 gigawatt hours per year from the three battery plants, which the DOE’s Loan Program Office estimates will replace more than 455 million gallons of gas per year.

- In 2009, Ford also borrowed $5.9 billion to refit 13 factories in six states to upgrade the Escape, Fiesta, Focus, Taurus, and F-150 with downsized, turbocharged EcoBoost engines.

A $9.2 billion loan guaranteed by the US Energy Department will help finance three battery factories in two states in a joint venture by Ford Motor Co. and South Korean giant SK On Co., Bloomberg reports.

The factories have a total price tag of $11.4 billion, and the joint venture known as BlueOval SK had already been awarded subsidies by the Kentucky and Tennessee state governments, meaning “taxpayers would be providing low-interest financing for almost all of the cost,” according to Bloomberg.

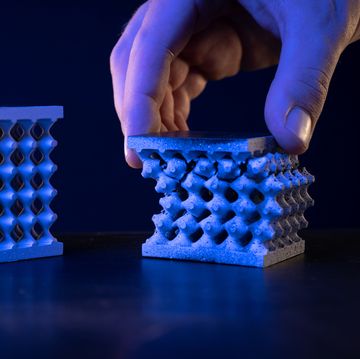

The two plants in Kentucky (Ford truck plant pictured above) and one in Tennessee will open in 2025 and employ 7500 people, according to The New York Times, which reports they are among the largest such plants being built by automakers and battery companies.

BlueOval SK, which is a 50/50 joint venture between Ford and SK On, has planned capacity of 120 gigawatt hours per year from the three plants, which the DOE’s Loan Program Office estimates will replace more than 455 million gallons of gas per year for the lifetime of the vehicles powered.

“BlueOval SK will use this loan to its fullest as we create 7500 good American jobs, strengthen critical domestic supply chains, and produce high-quality batteries for future Ford and Lincoln electric vehicles here in Tennessee and Kentucky,” the joint venture’s CEO, Robert Rhee, says in a prepared statement.

SK separately has received $300 million in incentives and free land for a factory under construction in Georgia, with no connection to Ford. SK is a subsidiary of Sunkyong, a South Korean conglomerate connected to the oil industry that has ventured into the EV business.

Ford and Lincoln electric vehicles also will benefit from the Inflation Reduction Act’s $370 billion in clean-energy funding, along with other automakers assembling electric cars and trucks with batteries, motors, and minerals sourced from the US and its eligible trade partners.

Such new EVs are eligible for up to $7500 in tax incentives in the White House program passed by Congress last year and challenged by Republican members in debt-ceiling negotiations this year.

The DOE’s “deep-pocketed” loan guarantee program made about $16 billion in clean-energy loans during the first three years of the Obama administration and was essentially moribund during the Trump administration, says the Times.

That article also quotes loan programs office director Jigar Shah that BlueOval SK will pay the same interest rate that the federal government pays when borrowing from investors, a “far better rate than would typically be available to a corporation.”

General Motors received a $2.9 billion loan from the same program last December.

The latest loan is not the first to benefit Ford. In 2009, the automaker borrowed $5.9 billion to refit 13 factories in six states to upgrade the Escape, Fiesta, Focus, Taurus, and F-150 with downsized, turbocharged EcoBoost engines.

“The resulting state-of-the-art assembly and manufacturing plants have the enhanced flexibility of producing multiple-platform, fuel-efficient advanced technology vehicles in response to changing market demands and fuel-economy standards,” the DOE says of that 2009 loan on its website.

It had claimed 33,000 jobs created by the loan, with more than 6 million Fords built in the plants saving 268 million gallons of gasoline and cutting 2.38 million metric tons of CO2 emissions per year.

When combined, the 2009 Ford and 2023 BlueOval SK DOE loans are dwarfed by GM and Chrysler’s 2009 Targeted Asset Relief Program loans connected to their bankruptcy reorganizations (when Fiat took over Chrysler).

Of approximately $80 billion loaned to the two US automakers, the federal government lost about $14 billion, the Congressional Budget Office said in a 2021 report.

Ford’s 2009 clean energy loan from DOE was far overshadowed by a $500 million loan guarantee to solar-power technology startup Solyndra, which closed down in 2011. Since then, Chinese manufacturers have dominated the solar industry.

The DOE program also benefitted Tesla, which in 2010 received a $465 million loan to help launch its Model S at the Fremont, California, assembly plant it got for free after the GM bankruptcy ended its joint venture there with Toyota.

How much financial assistance should governments—at home or abroad—provide automakers to expand all-electric offerings? Please comment below.

As a kid growing up in Metro Milwaukee, Todd Lassa impressed childhood friends with his ability to identify cars on the street by year, make, and model. But when American automakers put an end to yearly sheetmetal changes, Lassa turned his attention toward underpowered British sports cars with built-in oil leaks. After a varied early journalism career, he joined Autoweek, then worked in Motor Trend’s and Automobile’s Detroit bureaus, before escaping for Mountain Maryland with his wife, three dogs, three sports cars (only one of them British), and three bicycles. Lassa is founding editor of thehustings.news, which has nothing to do with cars.